"You don’t sell a business. You sell a machine that runs without you. Build the machine."

Adam Kreek

Founder Built for Hard

How to Maximize Enterprise Value When Selling Your Business

posted in Business Coaching

Contents

The key to a premium exit isn’t just revenue—it’s reducing owner dependency across six critical systems.

Only 10% of businesses that go to market get the value they expected... Why?

Because the business is too dependent on the owner.

You are the bottleneck.

You might also be the engine, the steering wheel, and the cupholder.

If your business grinds to a halt when you're on vacation, you've built a job, not an asset. And buyers don’t want to buy jobs. They want to buy systems.

Reframing Enterprise Value: The Four Freedoms of Ownership

When most people hear “enterprise value,” they think about preparing to sell their business. But here’s the truth: even if you’re not planning an exit, enterprise value is still one of the best frameworks to identify and prioritize strategic initiatives inside your business.

Why? Because enterprise value isn’t just about the price tag when you sell—it’s about building a business that runs smoother, creates more optionality, and delivers the real rewards of entrepreneurship: the Four Freedoms.

- Freedom of Money. Yes, financial security matters. But in my experience, money is rarely the top motivator. It’s table stakes. The owners and leaders I coach care about much more than a bigger bank balance. Money matters, but other things like family, community and health matter way more.

- Freedom of Time. The ability to choose when and how you work—and to spend time with people you love—is priceless. A business with strong systems and enterprise value gives you back your calendar.

- Freedom of Purpose. A well-run business amplifies your deeper mission. Whether that’s changing your industry, serving your community, or modeling values for your kids, enterprise value creates the stability to pursue purpose with vigor.

- Freedom of Relationships. When your business is healthy, you get to choose who you work with—and who you don’t. You can fire misaligned clients or let go of team members who no longer fit, without fear of destabilizing the company.

This is values-driven achievement in action. Enterprise value isn’t just a metric for buyers—it’s a roadmap for living and leading with freedom today.

The reality is that you are going to exit your business at some point. Let that sink in.

And most business owners rarely get the payout they expect—very few actually sell. That’s why we use the 5D’s of enterprise value, not just to prepare for a transaction, but to build a business today that delivers the freedoms you deserve.

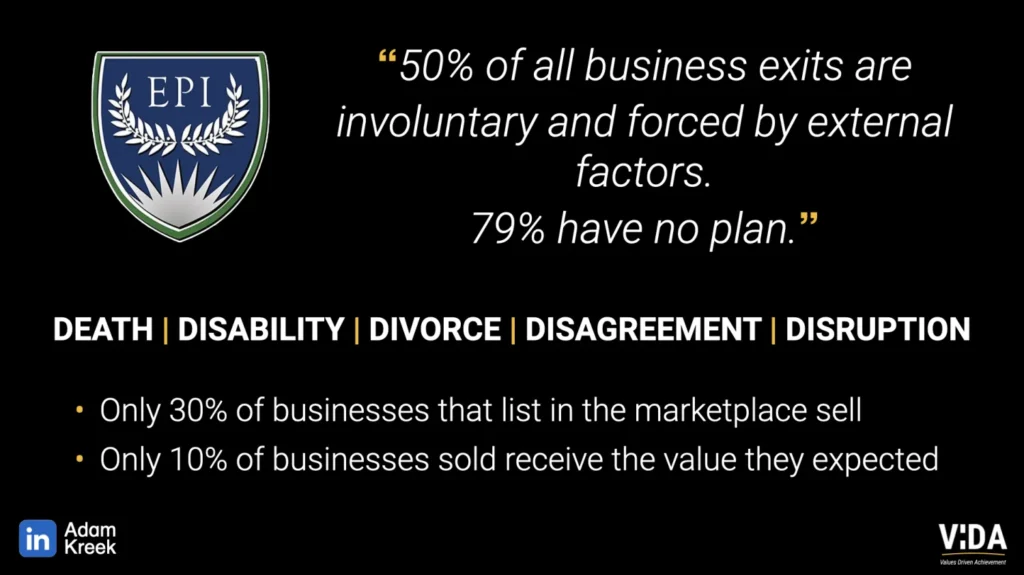

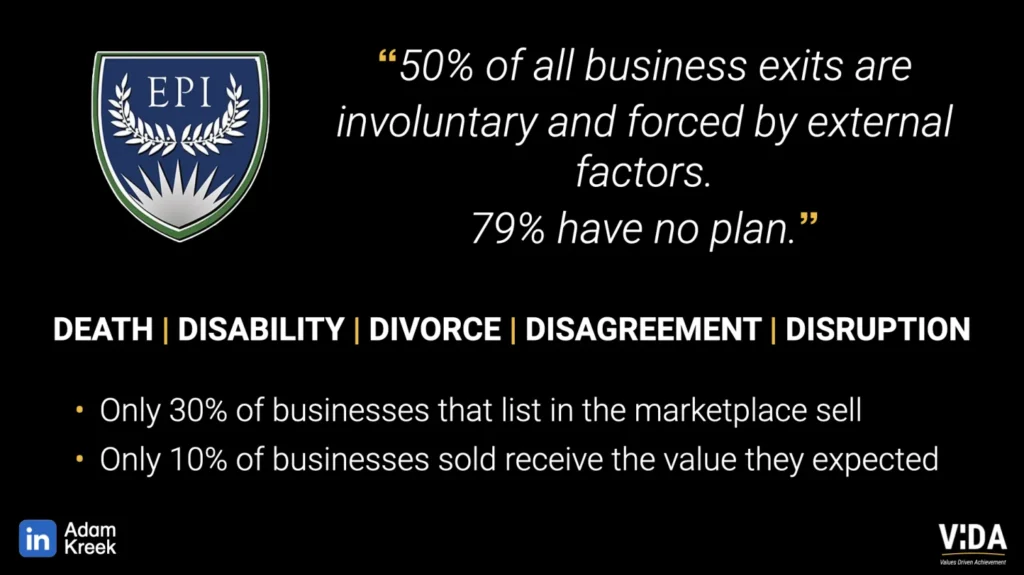

The Shocking Truth About Business Exits

Let’s start with the data:

“50% of all business exits are involuntary and forced by external factors.

79% have no plan.”

— Exit Planning Institute (EPI)

And if that’s not enough to make you reach for the aspirin:

- Only 30% of businesses that list in the marketplace actually sell

- Only 10% receive the value they expected

The lesson?

Exit planning isn’t optional. It’s urgent.

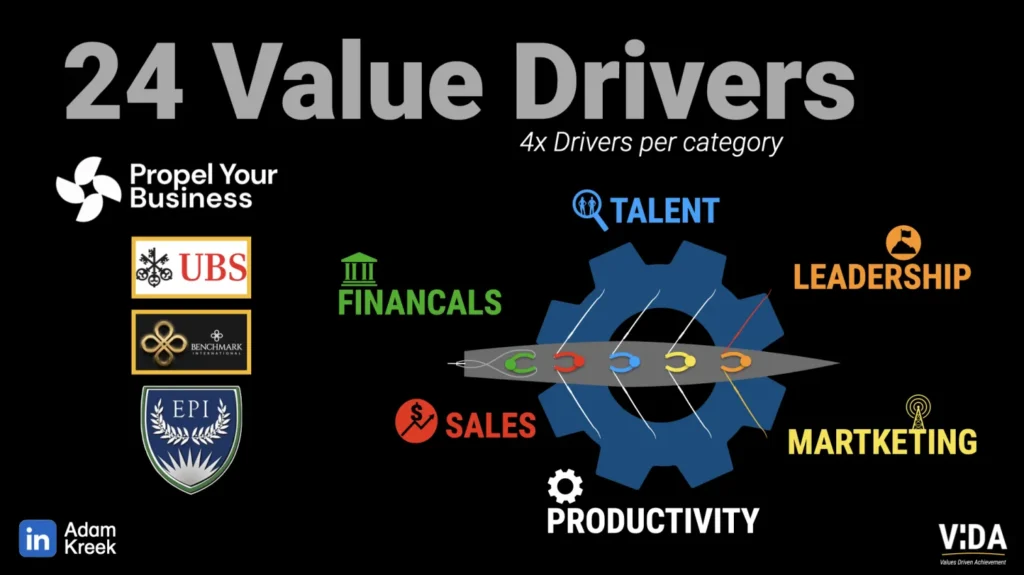

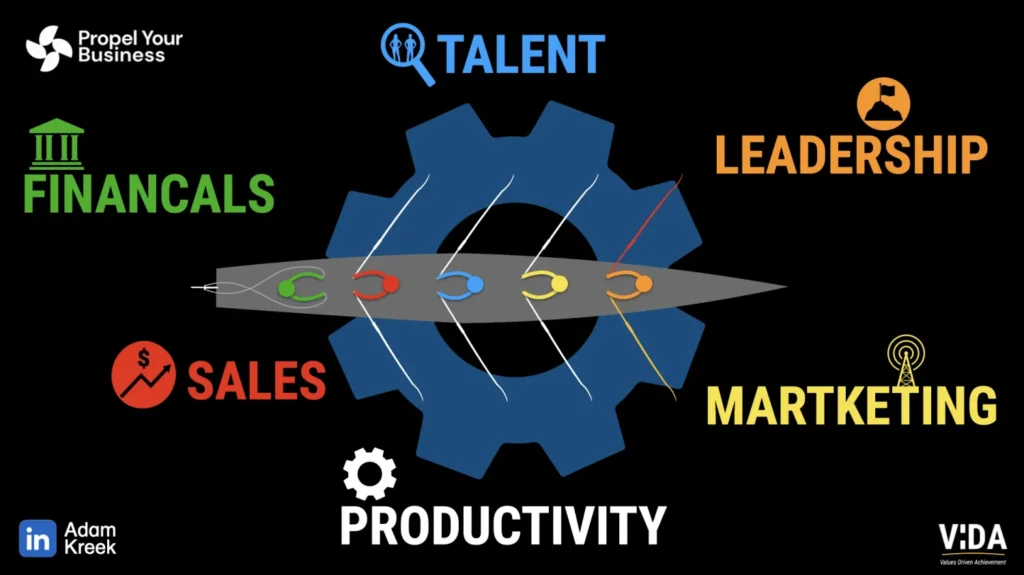

The 24 Value Drivers: Stop the Chaos and Build a Sellable Business

Based on frameworks from Propel Your Business, EPI, and Cultivate Advisors, we’ve identified six enterprise value categories. Each includes four key drivers to stop the chaos and boost your valuation.

If you're looking to sell your business—or just want it to run without sucking the life out of you—these are your playbooks.

Row Your Business Like a High-Performance Boat

Imagine your business as an ocean quad—gliding through unpredictable waters toward a clear destination. It’s lean. Fast. Powerful. But only if the right people are in the right seats—and doing the right work.

I’ve rowed across the Atlantic. I’ve trained with Olympic crews. And I’ve built businesses with leaders who row their companies just like these high-performance boats.

Here’s how the metaphor works—and what it teaches us about reducing owner dependency:

- The Coxswain is your Financial System. (Green)

They face forward. They have the best line of sight on the future. With clean cash flow forecasts and strong KPIs, they steer with clarity. But when the rudder turns, the boat doesn’t respond instantly. Just like a financial decision, it takes a few strokes for results to show. - The Stroke Seat is Sales. (Red)

This is the pacemaker. When sales are strong, the business moves fast. When sales slow, everything else lags. A predictable pipeline keeps your company in motion—and off the rocks. - Seat Three is Talent. (Light Blue)

The engine room. This is the most powerful rower of the boat, and it’s no accident in this model. Business is driven by people, stupid. And, it’s the systems that attract, retain, and grow your top players that generate real enterprise value. - Seat Two is Marketing. (Yellow)

Often the loudest voice in the crew. Marketing calls attention to where the opportunity lies—outside the boat. It fuels the pipeline and attracts the resources needed to keep rowing. If your team can’t hear the call clearly, the whole crew loses rhythm. - The Bow Seat is the Leader. (Orange)

That’s you. You have a unique vantage point: you can see the crew. You feel the boat. And you can take a few strong strokes on port or starboard to correct the course real fast. But the lesson is humbling—the boat is not about you. You are here to maintain the rhythm and observe the entire system in motion. - Productivity is the Gear. (Dark Blue)

It’s the interaction between the oar and the water. It's blue like talent, because... well... it's the people that drive productive systems, stupid. Efficiency. Leverage. Systems. Your SOPs, dashboards, and KPI rhythms are the gears that turn motion into momentum—especially if they are people-first designs.

When all six seats are aligned—financials, sales, talent, marketing, leadership, and productivity—you row with power, precision, and purpose.

When one is missing? You drift, slow down, veer off course, or stop moving altogether.

Let's dig deeper into each of the categories:

FINANCIALS: Clean Books, Predictable Cash, Intelligent Growth

A buyer wants clarity and confidence in your numbers.

Key Drivers:

- Financial statements are accurate and timely

- Revenue is predictable and recurring

- Margins are growing—not shrinking

- Cash flow is strong and monitored

Red Flag: If you can't show a 3-year trend of clean books, you’re asking buyers to believe a story without data. Good luck.

SALES: Predictability, Pipeline, and Transferability

Buyers want to know: Where does the next dollar come from?

Key Drivers:

- Reliable sales process

- Documented pipeline management

- Diverse client base (no whale risk!)

- Performance metrics (and people) are tracked

Problem: If the founder is the top salesperson, you’ve just devalued your business.

TALENT: Systems for People, Not Just People in the System

People build your business. But systems scale it.

Key Drivers:

- Clear accountability structure

- Strong leadership bench (not just you!)

- Proven hiring process

- Retention of A-players

Owner Dependency Trap: If your top talent leaves when you leave, your business isn’t valuable—it’s volatile.

MARKETING: Message, Measurement, and Maturity

Your story sells before your team does. Is it working?

Key Drivers:

- Clear value proposition

- Established marketing engine (not just word-of-mouth)

- Multi-channel lead generation

- Measurable marketing ROI

Quick test: Can your sales team explain your unique selling proposition in under 30 seconds? If not, you’ve got work to do.

LEADERSHIP: Vision, Values, and Exit-Ready Culture

Culture drives value—but only if it’s documented and repeatable.

Key Drivers:

- Clear values that guide decision-making

- Mission-driven strategy (tied to long-term ROI)

- Succession planning in place

- Measurable culture metrics (like engagement or NPS)

Insight from ViDA: When personal values and company values align, performance improves. And yes—buyers can feel that.

PRODUCTIVITY: Systems > Superstars

Systems scale. People burn out.

Key Drivers:

- Standard operating procedures (SOPs)

- KPIs tracked and reviewed

- Technology supports, not replaces, performance

- Accountability rhythms (meetings, reports, dashboards)

Olympic lesson: Rowers win races with rhythm, not brute force. Your team needs rhythm, not heroics.

Stop Being the Bottleneck: Move from Hero to Architect

You can’t sell what you are. You can only sell what you built.

The most valuable businesses:

- Run without the owner

- Operate through systems

- Scale through people and processes

If you are the business, your business isn’t worth much.

Why Most Businesses Fail to Exit Well

Let’s go back to the data from the Exit Planning Institute:

Five Ds derail most business exits:

- Death

- Disability

- Divorce

- Disagreement

- Disruption

And 79% of business owners have no plan. Don’t be one of them.

So, What’s Next?

If you're serious about maximizing enterprise value:

- Audit your owner dependency: Where are you still in the weeds?

- Assess your 24 Drivers: Which of the six categories is your biggest gap?

- Build a team of advisors: You can’t fix this alone.

- Create an exit plan—even if you're not selling yet. Start now.

Enterprise value is built in years, not months.

You don’t sell a business. You sell a machine that runs without you. Build the machine.

BONUS: Want a Custom 24 Driver Assessment?

Let’s audit your business together.

Reach out and we’ll map your current value across these six categories, using proven methodology from UBS, Benchmark International, and EPI—adapted for Canadian businesses and values-based leaders.

Book a call or message me directly on LinkedIn.

–––––

Adam Kreek and his team are on a mission to positively impact organizational cultures and leaders who make things happen.

He authored the bestselling business book, The Responsibility Ethic: 12 Strategies Exceptional People Use to Do the Work and Make Success Happen.

Want to increase your leadership achievement? Learn more about Kreek’s coaching here.

Want to book a keynote that leaves a lasting impact? Learn more about Kreek’s live event service here.